Biogas and Biomethane: Highly Favorable Prospects Again in France

Methanization, Biogas, Biomethane, Green Gas, Renewable Gas, Vehicle Natural Gas (VNG), BioVNG: What are we talking about?

What is Methanization?

The Methanization est un processus reposant sur la décomposition de matières dites putrescibles (dotée de la capacité de pourrir) par des bactéries qui agissent en l’absence d’air. On parle ainsi de fermentation ou de digestion anaérobie (en l’absence d’oxygène). La méthanisation est un phénomène qui se produit à l’état naturel, par exemple dans les marais avec des émanations de gaz. Mais il peut également être reproduit de manière industrielle dans des unités de méthanisation (ou méthaniseurs) en laissant fermenter les matières organiques plusieurs semaines dans un digesteur sans oxygène.

The methanization process generates two elements:

- Some Biogas composed mainly of methane (50% to 70%), carbon dioxide, as well as hydrogen sulfide, and sometimes water in smaller quantities.

- A by-product called digestate, which can be used as fertilizer for agricultural soils.

This biogas can be converted into heat, used to produce electricity (or both simultaneously in a combined heat and power cogeneration unit).

The biogas can then be purified. During these operations, carbon dioxide (decarbonization), hydrogen sulfide (desulfurization), and water (dehydration) are removed. It then becomes biomethane, which has the same characteristics as natural gas. Biomethane can thus be injected into the gas network. It can also be used as fuel for vehicles. This is referred to as bioVNG to distinguish it from VNG (Vehicle Natural Gas) when natural gas is used as fuel. The outlets are therefore multiple and can supply several sectors.

Both biogas and biomethane are renewable gases (also called green gases) derived from waste valorization.

A Key Challenge: Input Sources

There are a large number of input sources that can feed methanization units:

- Agricultural waste (manure, slurry, etc.)

- Household and municipal waste (household biowaste, green waste, etc.)

- Urban waste (biowaste from collective catering and supermarkets, etc.)

- Agri-food industry waste (material loss in the process)

- Industrial waste (industrial sludge, production rejects, etc.)

- Sewage sludge (from wastewater treatment plants)

However, these inputs have very different methanogenic powers (i.e., the amount of methane released per ton at the output of the digester).

Indeed, the methanogenic potential varies greatly depending on the product and its level of putrescibility. One of the few exceptions is wood waste, as anaerobic microorganisms are unable to degrade lignin.

In the agri-food industry, methanogenic powers are just as disparate.

Example: One ton of oat straw yields three times more methane biogas than one ton of energy maize. Thus, oat straw finds a new and valuable valorization, after being used for bedding, as fuel bricks, and livestock feed.

Sewage Treatment Plants: a Financial Opportunity to Seize

The sludges from the stages of wastewater treatment are organic waste with high methanogenic potential. Their methanization therefore produces biogas rich in methane. Furthermore, methanization helps reduce the remaining sludge volumes by 20% to 50%, thus reducing their management costs.

Moreover, the valorization of the produced gas can provide additional income to the facility through various public support mechanisms.

The AGEC law (anti-waste law for a circular economy) is expected to boost input volumes. Already imposed on the largest producers, source sorting and valorization of biowaste will be generalized to everyone as of January 1, 2024, requiring professionals and communities to organize appropriate collection circuits.

Development of Biomethane and Biogas: a Priority for Europe

The European Union has made the development of biomethane production one of its priorities, for three main reasons:

- As a replacement for natural gas, biomethane contributes to Europe’s decarbonization strategy, with the aim of achieving carbon neutrality by 2050.

- Reducing Europe’s dependence on imported fossil fuels, particularly gas from Russia.

- Positive impact in terms of local growth and employment.

It should be noted that priority is now given to biomethane rather than biogas alone. Europe currently produces approximately 3.5 billion m³ of biomethane and around 17 billion m³ of biogas. Achieving European objectives by 2030 relies on both the sustained development of biomethane and the transformation of current biogas production units into biomethane production units.

According to the European Biogas Association (EBA), Europe had 1,322 biomethane production installations as of April 2023 (1,222 by the end of 2022), with a large portion installed in France.

The target is to

produce 35 billion m³ of biomethane in Europe by 2030.

Source : European Commission

France is among the European leaders.

According to data compiled by MéthaFrance, France had 1,705 installations producing and valorizing renewable gases in 2022.

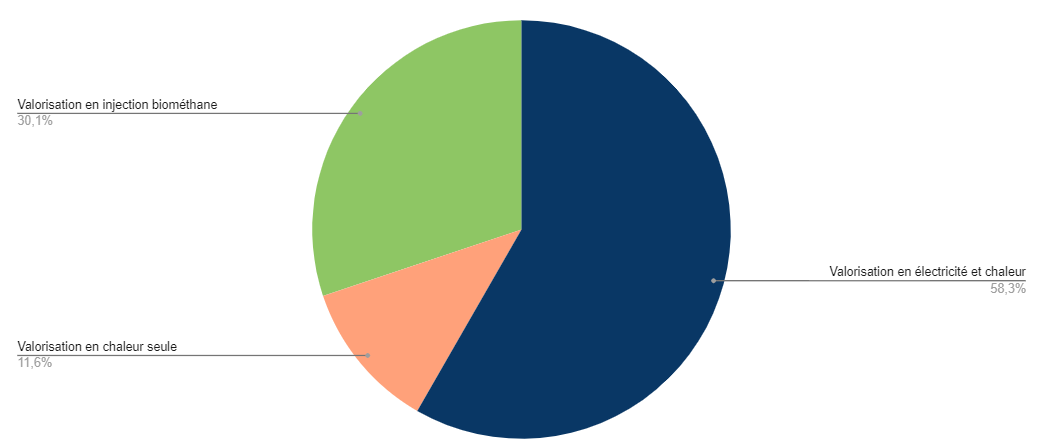

Characteristics of renewable gas production and valorization installations in France by the end of 2022 (number of units)*

*Data as of the end of 2021 for heat valorization alone.

Source : MéthaFrance

The majority of installations (58%) produce electricity and heat through cogeneration from biogas. These include methanizers, wastewater treatment plants, and non-hazardous waste storage facilities. The number of these installations increased by 5% in 2022 to 994 units. Electricity production from biogas represented 576 MW of installed electrical power by the end of 2022.

Still in 2022, the production of biomethane for injection represented 30% of total installations. France had, at the end of 2022, 514 units, almost twice as many as in 2020 (213 units). These are mainly agricultural units (441 units), far ahead of wastewater treatment plants (35 units).

This sector benefits from very strong growth (+41% in 2022) with 149 units commissioned in 2022. France alone accounts for more than 40% of biomethane production units in Europe. France had biomethane production of 7 TWh in 2022.

At the end of 2022, nearly 900 projects in the queue were identified, which should allow the sector to continue its growth, subject however to effective support provided by the public authorities.

Public support mechanisms available for your project

The methanization sector has experienced strong growth but is currently facing a downturn. Faced with the dynamism of the sector, the authorities decided to reduce the biomethane feed-in tariff in November 2020, with an average decrease of around 10%. Quarterly degression was also introduced at the same time. The authorities aimed to avoid a bubble that could have been costly to the state finances.

At the same time, methanization units, like many industrial sites, experienced a surge in their costs due to inflation, rising costs of certain raw materials, but especially due to the increase in electricity prices. In this context, many projects encountered difficulties in securing their financing, leading to a significant increase in projects in the queue.

In response, the authorities issued a new tariff decree in June 2023, increasing the biomethane feed-in fee by over 10% or even 15% (depending on the size of the sites). Moreover, this cost will be subject to indexation linked to energy price variations. Tenders are also being organized by the Energy Regulatory Commission, notably the one launched in 2022 with three tranches: 500 GWh/year in December 2022, 550 GWh/year in June 2023, and again 550 GWh/year to come in December 2023. For each tranche, a quota of 200 GWh/year is reserved for projects producing less than 50 GWh/year. Winners will benefit from a 15-year feed-in contract. This provides breathing room and visibility to the sector.

What are the prospects for renewable gases in France?

The current Multiannual Energy Program (PPE) sets a target for biogas development of 14 TWh/year, including 6 TWh/year of injected biomethane by 2023. In 2022, 9 TWh of biomethane were injected into the network. Therefore, the targets for 2023 will already be largely exceeded. For 2028, the PPE targets are 24 to 32 TWh of biogas, including 14 to 22 TWh of injected biomethane.

According to the Ministry of Energy Transition, as of December 2022, 876 biomethane injection installation projects were in the queue for a production capacity of 15.8 TWh/year. The commissioning of projects currently in the queue would already allow the 2028 targets to be exceeded.

However, a new PPE – eagerly awaited by all stakeholders – is currently being prepared. It should confirm a significant increase in the targets for the development of biogas and biomethane in France. As soon as it is published, we will keep you informed of the objectives for the development of renewable energies in France in a future article.

In the meantime, do not hesitate to contact us to discuss the best opportunities to seize for your project.