Power Purchase Agreements (PPAs): Benefits in the Face of Rising Energy Prices

PPA: Definition

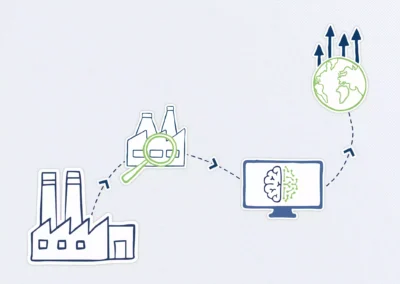

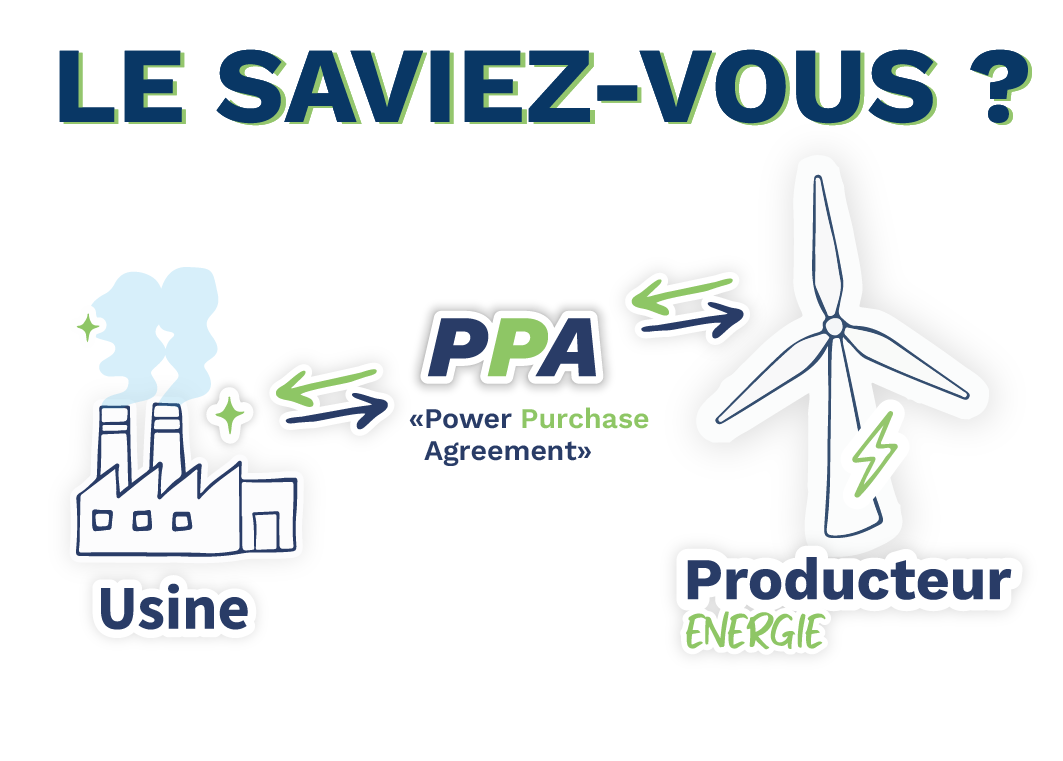

A PPA, or Power Purchase Agreement, is a contract for the supply of electricity signed directly between a producer (seller) and a consumer (buyer). This is why it is referred to as a corporate PPA (or CPPA). Electricity suppliers can also sign PPA contracts with renewable producers. In this case, it is referred to as a utility PPA (or UPPA).

In its most classic sense, PPAs concern the supply of green electricity. Therefore, the electricity supplied comes from renewable production sources, mainly solar photovoltaic, onshore wind, and offshore wind.

The majority of PPAs are signed over a multi-year period, typically between 10 and 20 years. However, it is possible to sign PPAs for a duration of less than 10 years.

18 years

The average duration of PPAs signed in France in 2022

Sources: Alterna, Sorégies, Sia

Brownfield, greenfield, physical on-site, off-site, virtual… A wide range of PPAs exists.

The generic term PPA actually covers many situations, providing numerous options for clients opting for this type of contract.

Firstly, the contract can be based on:

- An existing renewable production asset (referred to as a brownfield PPA)). In this case, it typically involves a renewable production park no longer benefiting from government support. For example, it could be an onshore wind farm that benefited from government feed-in tariffs for 15 years and is now in its 16th year of production.

- A project asset, which is not yet producing renewable electricity (referred to as a greenfield PPA)). In this case, signing a long-term PPA guarantees the producer’s income, which can help secure project financing.

Additionally, the contract can be:

- A “physical” PPA. In this case, the contracted volumes are integrated into the client’s consumption. For example, a company can sign a PPA for a volume representing 15% of its annual electricity consumption.

More specifically, it is then referred to as a “physical on-site Power Purchase Agreement” when the production asset is directly connected to the consumer (for example, a solar PV plant on a company’s site). However, this situation is quite rare. Most often, it is referred to as a “physical off-site Power Purchase Agreement” when the production asset is connected to the electricity transmission or distribution grid.

- A “virtual” PPA (or “synthetic” PPA) In this case, the consumer commits to paying the difference between the contracted price and the market price of electricity. This is actually a financial product.

Two main options are typically offered regarding the contracted volumes in a Power Purchase Agreement:

- A fixed volume of electricity. The consumer receives a predetermined volume in advance (for example, 200 MWh/year).

- A percentage of the electricity produced by the renewable asset. In this case, the consumer will not receive the same amount of electricity every day; it will vary depending on the performance of the production asset. This is referred to as a “pay-as-produced” clause.

Finally, two main pricing options can be offered:

- A negotiated fixed price between the seller and the buyer, which may optionally be indexed to a parameter defined in the contractual clauses (such as the inflation rate). This is the most common case.

- A price linked to the electricity market price. This scenario is rare as it reduces the main advantage of PPAs: the predictability of electricity prices over time.

A Growing Market

The global market for Power Purchase Agreements (PPAs) is very dynamic. According to BNEF, it grew by 21% in 2021, 32% in 2022, and 12% in 2023.

According to Pexapark, 16.2 GW of PPA contracts were signed in Europe in 2023, representing a 41% growth compared to 2022. These contracts are primarily based on solar plants (65%), onshore wind farms (14%), and offshore wind farms (12%).

198 GW

The total volume of Power Purchase Agreements signed worldwide between 2008 and 2023

46 GW

The volume of PPAs signed worldwide during the year 2023.

Sources: BNEF

In total, 272 contracts were signed in Europe in 2023, with an average volume of nearly 60 MW per contract.

France ranks 7th in the European market with a volume of 640 MW in 2023, far behind Spain (4.7 GW), Germany (3.7 GW), and Italy (1.1 GW). However, an increasing number of electricity consumers are showing interest in this type of contract.

Moreover, the Power Purchase Agreement market is expected to grow significantly in the coming years. As part of the reform of European electricity markets, the European Commission has asked all Member States to encourage the signing of PPAs by removing any legal and administrative obstacles. The European Commission also recommended the establishment of public guarantees to promote the development of this type of contract, which France has done.

In November 2022, BPI France launched a guarantee fund for Power Purchase Agreement contracts in France. The aim is to financially cover the contract by guaranteeing the default risk. On October 11, 2023, BPI France announced the signing of the first contract benefiting from this guarantee. It was a Power Purchase Agreement signed between renewable developer Arkolia and buyer Bonduelle for the supply of 12 GWh/year of electricity for 20 years.

Why Sign a Power Purchase Agreement Can Be Beneficial?

The interest of PPA contracts is to offer both parties long-term visibility on electricity prices.

Take the example of an industrial customer. This customer typically knows its electricity consumption and, in particular, its consumption “floor,” meaning the minimum consumption level it never falls below. Therefore, it can commit long-term to supply part of this floor.

Logically, the enthusiasm for Power Purchase Agreements is directly linked to wholesale electricity prices. When these prices are low, it is more difficult for renewable developers to offer a competitive price, while customers are more reluctant to contract for long periods.

Conversely, the surge in electricity prices has generated real enthusiasm among buyers who have rushed to this type of contract. Between September 2021 and April 2023, the wholesale electricity price remained largely above €100/MWh, compared to an average below €50/MWh over the previous ten years.

But beyond the current level of wholesale prices, PPAs mainly allow protection – for the volume of electricity consumption concerned – against future increases in wholesale prices, while opting for renewable electricity supply.