Why is the Price of Gas Rising?

The price of gas has been increasing year by year, prompting the French government to impose a price freeze to protect businesses and households from soaring prices. Without this announcement in October 2021, gas prices would have risen by more than 40%.

We will explore the factors that influence gas prices and ways to anticipate and mitigate the impact of rising prices.

What defines gas prices?

Gas prices, like many commodities, are dictated by supply and demand. How can we explain that gas prices stagnated in 2020, despite a significant drop in demand during lockdowns? This is due to sanitary restrictions that reduced global gas production. If production had remained the same, prices would likely have decreased. It is possible that gas producers preferred to avoid this, contributing to reduced production.

The Economic Recovery: A Factor in Gas Prices

When global activity resumed, the demand for gas increased sharply to power factories and businesses. This sudden surge in demand outpaced production, as many companies sought to make up for lost production during the pandemic. Thus, demand rose faster than production, causing gas prices to spike. Gradually, availability and demand for gas aligned, stabilizing prices, although they remain higher than pre-freeze levels.

Supply from Russia: New Gas Price Increases to be Expected?

In addition to the global pandemic, the war in Russia affects gas prices. This could result from reduced production in warring countries, logistical difficulties on supply routes, or simply increased consumption by warring countries to fuel their armies.

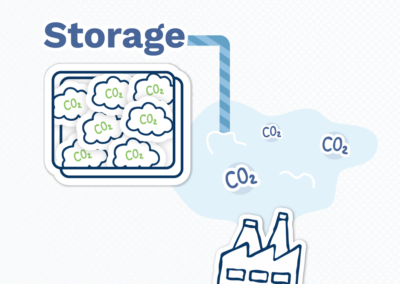

Gas Production from Russia Less Used in France

Russia is the world’s second-largest gas producer. During the conflict, exports may slow or stop due to political embargoes or because Russia retains its production to power overworked weapons factories.

However, we can note that France sourced only 11% of its gas consumption from Russia (in 2015), with Norway being the main supplier at 42%. This does not mean that the war will not impact gas prices in France.

The Impact of the War on Gas Prices

French businesses and households, with low dependency on Russian gas, might not be severely affected. However, this is not true for all European countries. Neighboring countries that rely more on Russian gas will need new supplies, increasing demand from other producers like Norway. If Russia stops exporting gas, demand from other producers will rise, causing gas prices in France to increase, similar to gasoline prices.

Additionally, Ukraine, although a minor gas producer, is a major transit route for gas from Russia to Europe. The conflict between these two countries likely means new supply routes will be needed, leading to potential congestion and supply difficulties. The cost of necessary logistical changes will also be passed on to gas prices. Currently, gas transit through Ukraine from Russia has not been interrupted and has even increased due to competitive Russian prices compared to other European producers.

Gas Prices Frozen in 2022: Impact on 2023

To prevent French businesses from being affected by rising gas prices, the government decided to freeze prices in October 2021. In 2021, gas prices increased monthly before this announcement and continued to rise since. This measure aims to wait for prices to drop and includes a smoothing mechanism, meaning the savings made during the freeze will be offset by higher-than-market prices once the measure ends.

How to Prepare for Upcoming Gas Price Increases?

How to Prepare for Upcoming Gas Price Increases?

There are various ways to anticipate and protect against rising gas prices with the disappearance of regulated gas tariffs. The first step is finding the supplier offering the best rates. This change should occur when gas prices are low, and an increase is anticipated.

Negotiating an energy contract is a tedious task best handled with professional assistance, like Dametis.

Dametis helps consolidate your energy bill and best prepare for surprises with:

-

- Efficiency solutions for energy savings (producing more with the same energy or maintaining productivity with fewer resources)

- Accurate monitoring of energy consumption for realistic consumption-based negotiations

- Alerts to avoid exceeding maximum subscribed electrical power, reducing your bill!

- Alternative energy solutions: replacing fossil gas with renewable fuels

- Electrification of processes

This second solution allows you to know exactly how much gas your company uses so your supplier can provide a package including only the gas you need. This avoids paying for excess quantity and saves money without changing the gas price.

To anticipate gas prices, you can monitor factors affecting demand or production, such as pipeline incidents or economic recovery in certain global regions. Conversely, you can observe the development of new alternative energy sources, which, if widely used, will reduce gas demand.

To optimize your energy bill and avoid negative impacts from gas prices, contact Dametis.